Luxury products company Richemont reporting its financial results for the year ended March 31, 2018, said sales had increased by 3% at actual rates and 8% at constant rates, to € 10,979 million for the period, from sales worth € 10,647 million in the previous year . “Excluding the impact of exceptional inventory buy-backs, sales grew by 7% at constant rates,” the Company added.

The Company witnessed a strong retail performance reflecting solid jewellery and watch sales, with double digit growth in mainland China, Hong Kong, Korea and Macau.

“At constant exchange rates all regions grew, with the exception of Europe,” Richemont stated, summing up its performance. “Asia Pacific enjoyed double digit growth; the Americas and Japan posted mid to high single digit sales increases before accounting for adverse exchange rate impacts. Retail performance was strong, reflecting solid jewellery and watch sales; wholesale sales declined.”

Europe, accounting for 27% of the Company’s sales saw a decline — mainly due to the strength of the euro, but also combined with a number of other factors. Retail growth was reported to be “subdued” while wholesale sales in the region declined. Sales in Europe reached € 2,986 million for the year ended March 31, 2018 as against sales worth € 3,068 million reported in the previous year, marking a decline of 3%.

The United Kingdom, however, bucked the trend in the region to post good growth.

“Sales in Asia Pacific registered strong broad-based double digit growth,” continued Richemont on a more upbeat note. “This performance was led by China, Hong Kong, Korea and Macau, and, at product level, driven by jewellery and watches. Both retail and wholesale channels saw double digit growth. The region accounted for 40% of Group sales.” Sales in Asia Pacific for the period amounted to € 4,352 million as against € 3,903 million in the last year, marking a growth of 12%.

The Americas, with a 16% share of the Group’s sales, saw an increase of 1% (8% at constant exchange rates) to € 1,805 million as compared to the previous year’s sales of € 1,781 million, “driven by strong retail sales, supported by jewellery and clothing”. While online sales also showed an upward trend, the reopening of the Cartier flagship store in New York in September 2016, had a favourable impact on the year’s results. “Wholesale and watch sales both declined, impacted by inventory management initiatives,” the Company said.

In terms of distribution channels, retail sales for the period amounted to € 6,914 million from the previous year’s € 6,389 million, marking an increase of 8%. Wholesale sales declined by 5% to € 4,065 million from € 4,258 million in the previous year.

The contribution of retail sales, through the Maisons’ online stores and 1,123 directly operated boutiques, has increased to 63% of Group sales, up from 60% in the prior year.

“The double digit growth generated in the retail channel was fuelled by jewellery and watches with six net store openings including the internalisation of external points of sales,” Richemont reported.

The Group’s wholesale business, including sales to franchise partners, declined by 5%. Except for Asia Pacific, all regions had lower sales, which were impacted by watch inventory management initiatives, mentioned earlier.

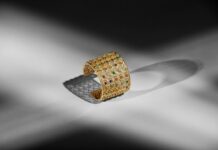

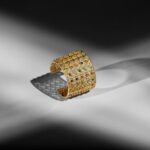

Looking at Richemont’s performance by segment, one sees that the sale of Jewellery Maisons rose to € 6,447 million for the period, from € 5,927 million in the previous year, registering a growth of 9%; the Specialist Watchmakers reported total sales of € 2,714 million as compared to € 2,879 million in the prior year, marking a decline of 6%; while the Others segment (including Montblanc, Fashion & Accessories, watch component manufacturing and real estate activities) reported sales amounting to € 1,818 million as against sales worth € 1,841 million in the last year, marking a decline of 1%.

“The performance of the Jewellery Maisons’ directly operated boutiques and, regionally, Asia Pacific and the Americas were particularly noteworthy,” Richemont underlined.

The Company’s operating profit for the period grew by 5% with an operating margin of 16.8%.

“Profit for the year rose by 1% to € 1 221 million,” the Company reported. “This increase reflects a higher operating profit and a higher effective tax rate. Net finance costs, at € 150 million, were broadly in line with the prior year.”

Earnings per share (1 A share/10 B shares) increased by 1% to € 2.158 on a diluted basis.

Richemont saw a strong generation of cash flow from operations with an increase of € 827 million to € 2,723 million.

The Company’s Board has proposed a dividend of CHF 1.90 per 1 A share/10 B shares, an increase of 6% from CHF 1.80 per 1 A share/10 B shares last year.

“An improved macroeconomic environment, steady progress on Richemont’s transformation agenda and a mixed currency environment marked the year under review,” remarked Richemont’s Chairman, Johann Rupert.

He added: “Excluding the one-time items in this year and the prior year, operating profit for the year would have increased by 10%.”

Referring to the new foray’s by the Company during the year, Rupert said: “Richemont’s voluntary tender offer for the world’s leading online luxury retailer YOOX NET-A-PORTER GROUP aims to accelerate our ability to satisfy today’s sophisticated and globally dispersed clientele and demonstrates our commitment to developing a robust omnichannel proposition. Reflecting our view that travel retail spending will increase over time, we also invested in Dufry, a leading travel retail specialist listed on the SIX Swiss Exchange.”

News Source : gjepc.org

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.