Budget 2018 Highlights: Finance Minister Arun Jaitley today presented the last full budget of PM Narendra Modi government. PM Modi in his reaction after the presentation said, “This budget has devoted attention to all sectors, ranging from agriculture to infrastructure.”

Budget 2018 Highlights India: Finance Minister Arun Jaitley today presented the last full budget of the PM Narendra Modi government – Jaitley met President Ram Nath Kovind at Rashtrapati Bhavan before presenting the Union Budget 2018-19 in Parliament. This is the last budget of the present regime since next year general elections will be held. So, in 2019, government will present an interim budget. The budget exercise will then be completed by the new government that will be sworn in post-poll. Significantly, in the lead up to Budget 2018 day, both PM Modi and FM Arun Jaitley had indicated that their budget will be about hard economics and not politics.

Therefore, most people’s expectations were that there would be very few sops for anybody. However, that it was expected to be a positive budget overall was signified by the fact that Sensex jumped in excess of 150 points ahead of presentation by the finance minister. In fact, the index regained the 36,000-mark by soaring over 171 points in opening trade itself. Just what did really happen in Parliament thereafter? Well, for starters, Cabinet approved the Union Budget for 2018-19, official sources revealed. FM Jaitley started the process by saying, “Budget 2018 will focus on strengthening agricultural and rural economy. When our govt took over India was considered one of the fragile five economies of the world; we have reversed it; India is today fastest growing economy. India is today a USD 2.5 trillion economy and will become fifth largest economy in the world from the present seventh largest. Govt focusing on ease of living now. We are firmly on path to achieve 8 pct growth”. Check out the Union Budget 2018 Highlights and key points here:

Income Tax Calculator: Find out how Budget 2018 will impact your finances

Budget 2018 highlights show exactly how the proposals announced by FM will impact all concerned. here is what you really must know to get the maximum benefit.

1. Govt has made many positive changes in the personal income tax rates applicable to individuals in the last three years, therefore, I do not wish to make any changes to this, Arun Jaitley said.

2. For senior citizens, exemption of interest income on bank deposits raised to Rs 50,000.

3. Rs 8,000 crore revenue lost due to standard deduction allowed to salaried employees.

4. Govt to reduce hardships faced in realty deals; no adjustment to be made in case circle rate does not exceed 5 pc of sale consideration

5. Standard deduction of Rs 40,000 allowed for transport, medical reimbursement for salaried tax payers.

6. Rs 7.5 lakh per senior citizen limit for investment in interest-bearing LIC schemes doubled to Rs 15 lakh

7. Cash payments exceeding Rs 10,000 by trusts and institutions will be disallowed in a bid to curb cash economy.

8. Strong case for long term capital gains from equities; 10 pc tax on long term capital gains in excess of Rs 1 lakh.

9. Education cess increased to 4 pc from 3 pc to collect additional Rs 11,000 cr

10. Tax on distributed income of equity oriented mutual funds at the rate of 10 per cent announced.

11. New scheme for providing electronic assessment to eliminate person-to-person contact

12. Customs duty on mobile phones to be hiked to 20 per cent from 15 per cent

13. Indian economy has performed very well since our government took over in may 2014. Now, India is a $2.5 tn economy, 7th largest in world, expect to become 5th largest soon. On PPP we are already third biggest economy. 6.2 pct GDP growth has signalled this strength. This year’s budget will focus on strengthening and building on these gains. Budget 2018 will focus on strengthening agricultural and rural economy. Modi government had promised to reduce poverty; we have taken decisive action. From ease of doing business, our government has moved to ease of living for the poor and middle class.

Budget 2018 Highlights India: Key points in Arun Jaitley presentation that you might have missed

Budget 2018 Highlights India: Key points in Arun Jaitley presentation that you might have missed

Budget 2018 Highlights: Finance Minister Arun Jaitley today presented the last full budget of PM Narendra Modi government. PM Modi in his reaction after the presentation said, “This budget has devoted attention to all sectors, ranging from agriculture to infrastructure.”

By: FE Online | New Delhi | Updated: February 1, 2018 2:28 PM

35

SHARES

SHARE

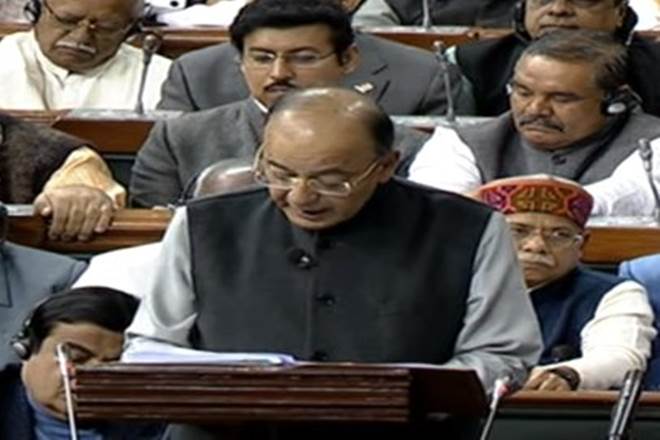

FM Arun Jaitley presents Union Budget 2018 today.Budget 2018 Highlights India: Indian economy has performed very well since our government took over in may 2014. Now, India is a .5 tn economy, 7th largest in world, expect to become 5th largest soon, says Arun Jaitley. (ANI)

Budget 2018 Highlights India: Finance Minister Arun Jaitley today presented the last full budget of the PM Narendra Modi government – Jaitley met President Ram Nath Kovind at Rashtrapati Bhavan before presenting the Union Budget 2018-19 in Parliament. This is the last budget of the present regime since next year general elections will be held. So, in 2019, government will present an interim budget. The budget exercise will then be completed by the new government that will be sworn in post-poll. Significantly, in the lead up to Budget 2018 day, both PM Modi and FM Arun Jaitley had indicated that their budget will be about hard economics and not politics.

Therefore, most people’s expectations were that there would be very few sops for anybody. However, that it was expected to be a positive budget overall was signified by the fact that Sensex jumped in excess of 150 points ahead of presentation by the finance minister. In fact, the index regained the 36,000-mark by soaring over 171 points in opening trade itself. Just what did really happen in Parliament thereafter? Well, for starters, Cabinet approved the Union Budget for 2018-19, official sources revealed. FM Jaitley started the process by saying, “Budget 2018 will focus on strengthening agricultural and rural economy. When our govt took over India was considered one of the fragile five economies of the world; we have reversed it; India is today fastest growing economy. India is today a USD 2.5 trillion economy and will become fifth largest economy in the world from the present seventh largest. Govt focusing on ease of living now. We are firmly on path to achieve 8 pct growth”. Check out the Union Budget 2018 Highlights and key points here:

Income Tax Calculator: Find out how Budget 2018 will impact your finances

Budget 2018 highlights show exactly how the proposals announced by FM will impact all concerned. here is what you really must know to get the maximum benefit.

1. Govt has made many positive changes in the personal income tax rates applicable to individuals in the last three years, therefore, I do not wish to make any changes to this, Arun Jaitley said.

2. For senior citizens, exemption of interest income on bank deposits raised to Rs 50,000.

3. Rs 8,000 crore revenue lost due to standard deduction allowed to salaried employees.

4. Govt to reduce hardships faced in realty deals; no adjustment to be made in case circle rate does not exceed 5 pc of sale consideration

5. Standard deduction of Rs 40,000 allowed for transport, medical reimbursement for salaried tax payers.

6. Rs 7.5 lakh per senior citizen limit for investment in interest-bearing LIC schemes doubled to Rs 15 lakh

7. Cash payments exceeding Rs 10,000 by trusts and institutions will be disallowed in a bid to curb cash economy.

8. Strong case for long term capital gains from equities; 10 pc tax on long term capital gains in excess of Rs 1 lakh.

9. Education cess increased to 4 pc from 3 pc to collect additional Rs 11,000 cr

10. Tax on distributed income of equity oriented mutual funds at the rate of 10 per cent announced.

11. New scheme for providing electronic assessment to eliminate person-to-person contact

12. Customs duty on mobile phones to be hiked to 20 per cent from 15 per cent

13. Indian economy has performed very well since our government took over in may 2014. Now, India is a $2.5 tn economy, 7th largest in world, expect to become 5th largest soon. On PPP we are already third biggest economy. 6.2 pct GDP growth has signalled this strength. This year’s budget will focus on strengthening and building on these gains. Budget 2018 will focus on strengthening agricultural and rural economy. Modi government had promised to reduce poverty; we have taken decisive action. From ease of doing business, our government has moved to ease of living for the poor and middle class.

Watch video: FM Arun Jaitley arrives in Parliament

Budget 2018: FM Arun Jaitley Arrives In Parliament

20. Put forth proposal to hike institutional credit for agriculture to Rs 11 lakh crore for 2018-19.

21. Food processing sector growing at 8 pc; allocation for food processing ministry being doubled to Rs 1400 cr.

22. Proposal made to hike target of providing free LPG connections to 8 crore to poor women.

23. Under Swachh Bharat Mission, Centre plans to construct 2 crore more toilets.

24. Kisan credit card facility extended to fisheries and animal husbandry sectors.

25. Institutional credit to agriculture to be raised to Rs 11 lakh cr in 2018-19.

26. Rs 16,000 cr to be spent on providing electricity connection to 4 cr poor households.

27. 1 cr houses to be built under Pradhan Mantri Awas Yojana in rural areas.

28. Quality of education still a concern. Education to be treated holistically without segmentation from class nursery to 12th. Govt to launch ‘Revitalising Infrastructure and Systems in Education by 2022. Govt to increase digital intensity in education. Technology to be the biggest driver in improving quality of education. To increase digital intensity in education, will move infra from blackboard to digital board. By 2022, every block with more than 50 per cent ST population will have Eklavya schools at par with Navodaya Vidyalayas.

29. Govt to establish a dedicated affordable housing fund under National Housing Bank for priority sector lending.

30. Focus of the government will be to provide maximum livelihood projects in rural areas. Govt to substantially increase allocation under national livelihood mission to Rs 5,750 cr in next fiscal.

31. Govt to launch Prime Minister’s Research Fellow Scheme which will identify 1000 B.Tech students to do Ph.D at IITs. Two new schools of planning and architecture to be set up; 18 more in IITs and NIITs.

32. Govt to launch flagship National Health Protection scheme to cover 10 crore poor and vulnerable people. Govt to set up 24 new medical colleges and hospitals by upgrading district level ones. 10 cr families will be provided Rs 5 lakh cover per family per year for treatment. Government is slowly but steadily progressing towards universal health coverage. 115 aspiration districts identified taking various indices of development into consideration, quality of life to be improved in these districts. Govt’s budget for health, education and social security increased to Rs 1.38 lakh crore for 2018-19 from Rs 1.22 lakh crore in current fiscal.

33. Allocation of Rs. 56,619 crore for SC welfare and Rs. 39,135 crore for ST welfare announced.

34. 115 “aspirational districts” to be made model districts of development.

35. Rs 4.6 lakh cr sanctioned under MUDRA Scheme

36. Environment for venture capitalists and angel investors to be strengthened

37. Employees PF Act to be amended to reduce contribution of women to 8 pc from 12 pc with no change in employer’s contribution

38. Contribution of 8.33% to EPF for new employees by the govt for three years and 12% govt contribution to EPF in sectors employing large number of people.

39. Rs 50 lakh cr needed for infrastructure building. National Highways exceeding 9,000-km will be completed in 2018-19

40. 99 cities selected for smart cities project with an outlay of Rs 2.04 lakh crore.

41. Indian Railways allocation in next fiscal now proposed at over Rs 1.48 lakh crore. 36,000-km of rail track renewal targeted in coming year. 4,267 unmanned railway crossings on broad gauge routes to be eliminated in next two years. Wifi, CCTVs to be progressively provided at all trains; escalators at stations with 25,000-plus footfalls.

42. Govt to expand capacity of airports by five times to cater to one billion trips a year. Regional air connectivity scheme shall connect 56 unserved airports and 31 unserved helipads.

43. SEBI may consider mandating large corporates to use bond market to finance one-fourth of their fund needs. Govt will monetise select central public sector enterprises using Infrastructure Investment Trusts.

44. 5 lakh WiFi hotspots to provide broadband access to 5 cr rural people.

45. Govt does not consider crypto-currency as legal; will take all measures against its illegal use.

46. Govt will evolve a scheme to provide a unique ID to every enterprise on lines of Aadhaar.

47. Rs 80,000 cr disinvestment target for 2018-19; Rs 1 lakh cr receipt expected in current year. Govt has initiated strategic disinvestment in 24 PSUs, including Air India.

48. Govt to formulate a comprehensive gold policy to develop gold as an asset class; gold monetisation scheme to be revamped. Gold monetisation scheme being revamped so that people can open gold deposit accounts in a hassle-free manner.

49. GST revenue for 2017-18 will be for 11 months; shortfall of non-tax revenue due to deferment of spectrum auction. Fiscal deficit for 2017-18 raised to 3.5 pc of GDP as against 3.2 pc previously estimated; for FY 19 deficit pegged at 3.3 pc as against 3 pc targeted previously.

50. Emoluments of the President to be revised to Rs 5 lakh per month & emoluments of the Vice-president to be revised to Rs 4 lakh per month. The Govt is proposing changes in refixing salaries of Members of Parliament. Law will provide automatic revision of emoluments of the MPs every 5 years indexed to inflation.

51. 372 specific business reform actions identified to improve ease of doing business; Evaluation of performance under this programme to be based on user feedback.

52. Will take all steps to eliminate the use of Crypto-Currencies, will encourage Blockchain technology in payment systems.

53. Tax payer base has risen from 6.47 crore in 2014-15 to 8.27 crore in 2016-17. Demonetisation was received by honest tax-payers as ‘Imaandari ka Utsav’. More payers joining tax net but turnover not encouraging.

54. Expenditure for 2017-18 pegged at Rs 21.57 lakh crore, as against Rs 21.8 lakh cr previously estimated. 12.6 pc growth rate in direct taxes in FY18. Rs 90,000 cr additional income tax collection in 2016-17 and 2017-18 due to measures against tax avoidance. Huge increase in tax returns filed; 85.51 lakh people filed returns in 2017-18, as against 66.26 lakh in 2016-17.

55. Reduced corporate tax by 25 pc extended to cos with turnover of Rs 250 cr to benefit small, micro and medium enterprises. Rs 7,000 cr revenue forgone on account of lower corporate tax for Rs 250 cr turnover companies.

56. Defence outlay raised to Rs 2.82 lakh crore in 2018-19 from Rs 2.67 lakh crore in current year.

57. Food subsidy to rise to Rs 1.69 lakh crore in 2018-19 from Rs 1.4 lakh crore in current year.

58. Market borrowing by govt to be lower at Rs 4.07 lakh crore in 2018-19 as against revised estimate of Rs 4.79 lakh crore in 2017-18.

59. Govt makes PAN mandatory for any entity entering into a financial transaction of Rs 2.5 lakh or more. PAN to be used as Unique Entity Number for non-individuals from Apr 1.

60. Gross budgetary support for Railways hiked to over Rs 3 lakh crore in 2018-19 from Rs 2.73 lakh crore in 2017-18.

PM Narendra Modi in his address to the media after the presentation of Budget 2018 spoke at length about its benefits for 125 crore Indians. PM said, “This budget has devoted attention to all sectors, ranging from agriculture to infrastructure. This Budget is farmer friendly, common citizen friendly, business environment friendly and development friendly. It will add to ‘Ease of Living’. The farmers, Dalits, tribal communities will gain from this Budget. The Budget will bring new opportunities for rural India. I congratulate the Finance Minister for the decision regarding MSP. I am sure it will help farmers tremendously.” PM added that this budget is “development-friendly” and will hasten India’s progress.

In his take on Budget 2018, Congress leader Manish Tewari said, “The government has attempted to pay lip service to farmers and to other marginalised sections of society, but it is a classical case of too less and completely at the inappropriate time.”

In his first reaction on Budget 2018, Congress leader and former Union finance minister P Chidambaram said that FM Arun Jaitley failed fiscal consolidation test, this failure will have serious consequences.

Calculate your income tax post budget 2018 through this Income Tax Calculator, get latest news on Budget 2018 and Auto Expo 2018. Like us on Facebook and follow us on Twitter.

News Source : finacialexpress.com

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.