Gemfields Group Pvt. Ltd.’s Interim Report 2019 for the six months ended June 30, 2019 (H1 2019), reported a revenue of US$ 88.960 million for the period, as compared to a revenue of US$ 102.131 million recorded for the first six months of 2018; thus registering a drop of 13% year-on-year (y-o-y).

The Company’s operating profit of US$ 23.497 million for the period under review dipped by 28% as against an operating profit of US$ 32.477 million reported in the same period of the previous year.

Of the total revenue for H1 2019, Gemfields’ Kagem Mining Limited operation in Zambia contributed US$ 33.194 million as compared to US$ 21.097 million in the previous year; Montepuez Ruby Mining Limitada (MRM) in Mozambique accounted for US$ 50.026 million in H1 2019 as against US$ 71.834 million in the same period of the previous year; revenue from Fabergé for H1 2019 stood at US$ 3.796 million as against US$ 7.039 million in the same period of the previous year; and Other revenue for H1 2019 amounted to US$ 1.944 million as compared to US$ 2.161 million in H1 2018.

Gemfields’ net profit for H1 2019 stood at US$ 12.443 million as against US$ 15.990 million earned for the same period of the previous year; marking a decrease of 22% y-o-y.

The Company’s net cash/debt however, stood at US$ 35.468 million and was up 12% over net cash of US$ 31.574 million reported for the same period of the previous year.

The Company announced that it has not declared an interim dividend.

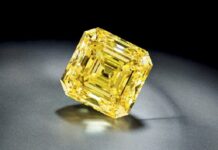

Gemfields’ Chairman Brian Gilbertson said: “Now given that we have put to bed the myriad of administrative matters necessary for completing the reshaping of the Company, our team has been focussing on what Gemfields does best: supplying precious coloured gemstones from Africa to global markets.”

He added: “The first six months of 2019 have seen Gemfields Group Limited deliver profitable but varied performance.”

One of the main issues before the Company pinpointed by Gilbertson was the high rate of tax imposed by Zambia. “Kagem’s most significant challenge at present is the 15% Zambian export duty imposed on emeralds since 1 January 2019,” he lamented. “When combined with the pre-existing 6% mineral royalty tax, Zambian emerald exporters must now pay an effective 21% turnover tax on their revenues. By contrast, the world’s second and third largest emerald exporters, Colombia and Brazil, have no export duty whatsoever and levy mineral royalties of just 2.5% and 2.0%, respectively.”

He also referred to the financial challenges faced by of the Jaipur (India) market which had impacted the Company’s sales in the recent past; adding however, that there were “encouraging signs of recovery”; and also that they have gained new clients for their emeralds.

New Source : gjepc

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.