Diamond trading was subdued in February as dealers geared up for the Hong Kong International Jewellery Show, held from March 1 to 5. The market remains segmented, with smaller diamonds outperforming those over 0.50 carats. The RapNet Diamond Index (RAPI™) for 0.30-carat polished rose 3.5% during the month, driven by a supply decline in the past year and renewed Chinese demand.

However, RAPI for 1-carat diamonds slid 0.1% in February and 21.7% year on year, though demand for VVS clarity in the RAPI category range offset weakness in VS. There were also sharp declines in SI goods.

The US economic uncertainty has made dealers cautious, with retail jewellers not replenishing inventory as they usually do in the first quarter. However, Valentine’s Day shopping boosted US jewellery sales by 6.5% YoY in January, according to Mastercard.

The focus has now shifted to the Far East after China lifted its Covid-19 restrictions and reopened its borders. While consumer spending is taking time to resume, jewelers expect a release of pent-up demand in the coming months.

Suppliers are offering discounts, especially for 1-carat and larger goods, to encourage Chinese buyers at the show, reduce excess inventory, and improve liquidity. Many exhibitors, however, were disappointed with the outcome.

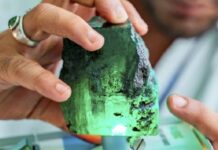

The rough market was steady in February as the drop in Alrosa supply prompted shortages. Factories are gradually raising polished production, anticipating better demand in the year’s second half. De Beers has raised prices on small rough for the second month in a row. Prices have also increased at auctions. New sanctions that the G7 nations intend to impose on Russian-origin diamonds will likely stimulate demand for non-Russian supply.

Sentiment was mixed in February, but polished trading is expected to improve as Chinese buyers gain confidence and US retail gains momentum.

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.