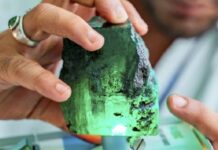

Gemfields, the London-based colored gems miner, reported record earnings for 2022, thanks to a post-Covid spike in demand for emeralds and rubies.

High demand drove up prices, especially in first half of the year, which resulted in a 32 per cent increase in revenue, to a record high of $341m.

But the miner, which owns 75 per cent of the Montepuez ruby mine in Mozambique and the Kagem emerald mine in Zambia, warned that recessionary fears would impact this year’s revenues.

It also faces ongoing challenges at Montepuez, where it has been forced to evacuate workers and halt operations at least twice because of attacks locally by Islamic State-linked insurgents.

Revenue from rubies was up 13 per cent on 2021 to $167m and from emeralds it increased 62 per cent to $147m.

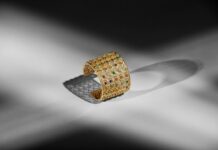

Gemfields said Faberge, the iconic brand it bought in 2012, had also delivered record revenues, up 28 per cent to $18m.

“The coloured gemstone market has seen strong demand after the Covid-19 pandemic, with prices paid for uncut emeralds and rubies reaching remarkable levels during the first half of 2022,” said Sean Gilbertson, Gemfields CEO.

“With recessionary fears now felt in some corners of the global economy, and against the backdrop of an inflationary environment, delivering the same financial performance in 2023 would be difficult to achieve.”

Disclaimer: This information has been collected through secondary research and TJM Media Pvt Ltd. is not responsible for any errors in the same.